which states have a renters tax credit

If your credit is more than the taxes you owe you can claim a refund. All of the following must apply.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Fifteen percent of 3600 is 540.

. Your California income was. The property was not tax exempt. Eligibility Requirements AgeDisability 32.

The Renters Tax Credit Program provides property tax credits for renters who meet certain requirements. Have a household gross income of 18000 or less. If your income is 11000 your tax limit is 265.

Dozens of California lawmakers are getting behind a bill that would raise a. The plan was modeled after and designed to be similar in principle to the Homeowners Tax Credit Program which is known to many as the Circuit Breaker Program. We issue Rent Paid Affidavits beginning March 1 each year.

The renters tax credit was established in 1972 and has increased just once in 1979. If all members of your household are under 65 the credit can be as much as 75. If there is a shortage of credits credits are then awarded to developments anywhere in the state.

For additional information see instructions. The majority of states that offer renters tax credits have very specific income parameters. The State of Maryland provides a Renters Tax Credit of up to 1000 for renters who meet certain requirements such as being 60 years of age or older or under 60 with at least one dependent child or being 100 disabled click here for more information.

California renters could get a big break from state under proposal to expand tax credit. The deadline for filing an application is October 1 2022. Submit Arkansas Individual Income Tax Schedule of Tax Credits AR1000TC to claim the credits.

Find your 2021 income and tax limit from the chart in the next column. A properly completed application means that all questions are. Thats because these programs help ease the financial burden of low-income households.

Renters Tax Credit Application Form RTC 2022 The State of Maryland provides a direct check payment of up to 100000 a year for renters who paid rent in the State of Maryland and who meet certain eligibility requirements. Review the credits below to see what you may be able to deduct from the tax you owe. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

See CRP Information for Landlords for more information. As long as your building is your primary residence located in Indiana and subject to. If you cannot get a CRP from your landlord you can request a Rent Paid Affidavit RPA to apply for the Renters Property Tax Refund.

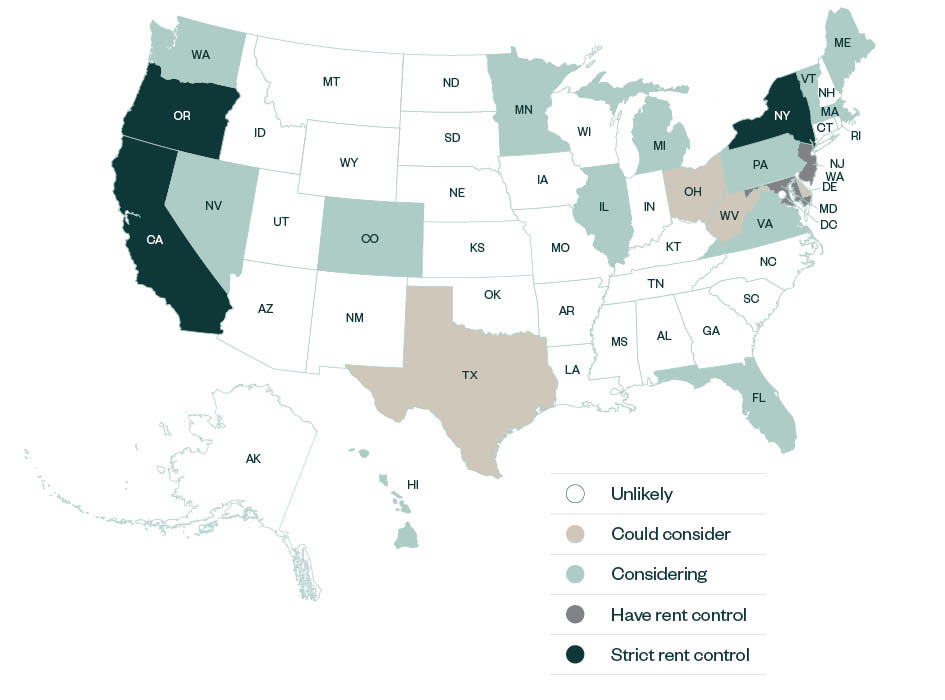

The programs in New Jersey New York Oregon and Texas as well as Washington DC are. Indiana is the exception. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page.

A monthly rental of 300 would amount to 3600 a year. It offers a broader renters tax credit for tenants. Funding of the Property Tax Credit 31.

87066 or less if you are marriedRDP filing jointly head of household or. New York NY offers a credit to renters who fulfill all of these requirements. A renter must meet the same age or disability requirements as a.

Several states have stopped accepting applications for federal pandemic rental assistance. To request an RPA you need the following information. You paid rent in California for at least 12 the year.

Renters A renter may qualify for a refund of a portion of the rent deemed to represent property taxes. How To Claim the Credit. Lived in the same New York residence for at least six months.

The concept rests on the reasoning that renters indirectly pay property taxes as. The rebate can be up to 250 125 if married filing separately and can be claimed when you file your state tax return. Since then median rent in the state has more than quintupled according to Glazers office.

43533 or less if your filing status is single or marriedregistered domestic partner RDP filing separately. If at least one member of your household is 65 or older the credit can be as much as 375. Take 15 of the total occupancy rent for the year 2021.

20 of the federal award. The state reimburses the counties for the full amount of credit allowed to each homeowner. For a direct link to the application for the State Renters Tax Credit click here.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Buying Vs Renting Doing The Math On What S Best For You Compass Mortgage

As Much As We Like Numbers We Know Buying Is Not Only About Numbers There Are Several Intangible Factors That Go Into The Buy Or Rent Rent Renter This Is Us

Impact Of Rent Control Laws On Real Estate Companies

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

What Is The American Opportunity Tax Credit What Is The Lifetime Learning Credit Credits For Qualified Edu In 2021 Life Insurance License Tax Preparation Tax Credits

University Of Illinois Extension

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Why I Added A Deductible To My Lease The Reluctant Landlord Being A Landlord Deduction Lease

Rent Application Form Template

Moving To Colorado Springs Renting Vs Buying A Home Real Estate Infographic Infographic Economy Infographic

Rental Property Owner Management Kit Rental Owner Printable Etsy Real Estate Information Being A Landlord Rental

Here Are The States That Provide A Renter S Tax Credit Rent Blog

Here Are The States That Provide A Renter S Tax Credit Rent Blog

Here Are The States That Provide A Renter S Tax Credit Rent Blog

5 Day Eviction Notice Free Printable Documents Eviction Notice 30 Day Eviction Notice Real Estate Forms

Tax Advantages Of Owning A Home Tax Deductions List Tax Deductions Tax Help